If you are worried about your financial future and want to find a reliable source to protect your financial well-being, then you are in the right place!

The Motley Fool has been involved in stock market investing as well as newsletter services for a long time, and it has always proved that it is one of the best services on the market.

Here’s a full review of the Motley Fool platform to help you evaluate if it is worth the price.

About Motley Fool

The Motley Fool is a multimedia financial services company which provides high-quality content on different topics such as stock market, personal finance, and investments.

The Fool was created in 1993 in Alexandria, Virginia by the Tom and David Gardner. Currently, the company has more than 300 employees.

When you head to the company’s website, you will find plenty of articles on important financial topics such as stocks, investing, and retirement planning.

Besides, the Fool’s community is very active and a helpful way for the different investors to share their opinion and valuable information about their different investment decisions.

Moreover, users have the opportunity to benefit from their paid services as well as competition-based crowdsourcing option.

The Motley Fool’s mission is simple: outperform Wall Street financial professionals and analysts as well as “beat the market.” You will find very useful content on the platform, which will certainly guarantee your success and help you gain high profits.

So, what makes the Motley Fool one of the best financial services on the market?

Motley Fool Free Content

The platform offers high-quality content about retirement planning and investing that is totally accessible to the public and free of charges.

Any investor searching for great information on how to invest efficiently, how to build a basic retirement portfolio, and how to get started with retirement planning will undoubtedly benefit from the Motley Fool’s service.

Here’s what you need to know about the different free features in the Motley Fool.

Stocks

Motley Fool provides the latest information on the stock market and on particular emerging stocks makings news on any particular day. Besides, there are plenty of articles on individual businesses written by employees as well as freelance writers.

Learn How to Invest

You will find a great section in the Motley Fool website which provides detailed information on how to get started. This is certainly the most helpful feature for novice investors because it covers all the fundamentals of investing. Any new investor without any knowledge about investing can easily read the different articles of the section to have a better understanding of investing and feel more self-confident.

How-to sections contain:

- Start Investing with $100 per Month

- How to Invest in Stocks

- Step-by-step Guide to Opening a Brokerage Account

In addition, the new investors might find the “13 Steps to Investing Foolishly” series very helpful as well.

Retirement Planning

Investing for the long-term is a very important step for every investor. That’s why you should definitely have a better understanding of the different retirement plans, especially if you are at your early stage of learning investing. You need to know the basics about your traditional IRA, Roth IRA, and 401(k) options. With the Motley Fool, you will find all the information you need about these different retirement plans with detailed and in-depth articles about each one of them. You will find the necessary information on IRAs and 401(k) as well as additional content about Social Security.

Also, you can benefit from the valuable content in the “13 Steps to Retire Foolishly” section. There are articles on retirement planning for people of different ages as well, from the 20s to 50s.

Furthermore, there are other helpful articles about retirement planning, such as:

- 6 Important Retirement Dates You Should Know

- Should I Get a Reverse Mortgage?

- Should I Get a Long-term Care Policy?

High-quality Podcasts

Recently, the Motley Fool has started a series of high-quality podcast on various personal finance and investing topics. You can find these podcasts on the Motley Fool website as well as through Stitcher and Apple iTunes.

Besides, there are podcasts with video on the their YouTube channel as well.

These podcasts include:

- Industry Focus. Every episode breaks down a particular industry and the top stocks worth highlighting.

- Motley Fool Money. It is taken from the company’s syndicated radio show. It features many analysts discussing the most critical investment stocks and news.

- Motley Fool Answers. It is focused on personal finance with helpful tips on planning, saving, and spending.

- Market Foolery. A series of short daily podcasts that focus more on the stocks in the current news.

- Rule Breaker Investing. The company’s co-founder, David Gardner, offers his opinion of the most innovative and disruptive publicly traded companies.

The Ascent

The Motley Fool launched the Ascent in July of last year, which is a portal entirely devoted to personal finance topics other than investing.

It features a massive collection of reviews of products related to finance, like savings accounts, credit cards, insurance products, and online brokerages. Also, the site offers information on rates of interest for banks, mortgages, personal and auto loans.

The Ascent runs as a distinct editorial entity, and a different team of analysts produces the content.

Premium Services

The price of the premium services ranges from $199 to $999 a year (though you can find promos to benefit from a reduction). Here’s a quick overview of the different premium services of the Motley Fool.

Stock Advisor

When subscribing to the Stock Advisor, you will get two stock recommendations every month, in addition to foundational stocks for new investors. Also, you can benefit from “best buy” stocks selection as well. The Stock Advisor costs $149 a year.

According to the Motley Fool, David Gardner’s picks have made a 527% return since the launch of the service, whereas Tom Gardner’s picks have made 149%. During the same period, the S&P 500 witnessed a 77% return, which proves that the Stock Advisor service is efficient and up to the users’ expectations.

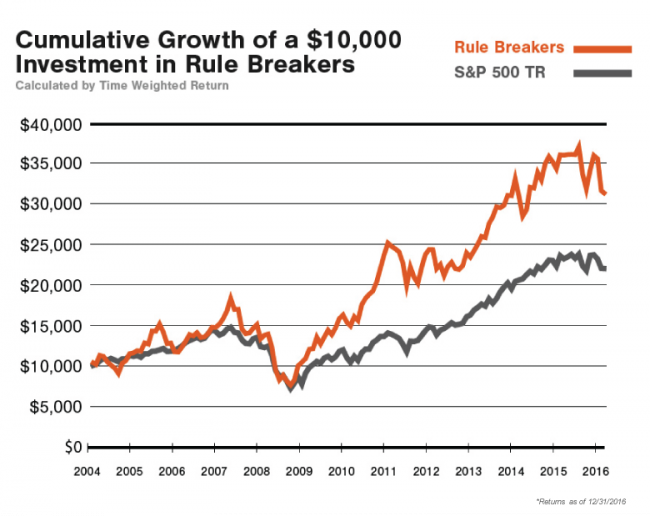

Rule Breakers

For $299 a year, you will benefit from recommendations for the best growth stocks. Also, it is important to note that the Motley Fool was one of the first services to recommend high-profile stocks, like Under Armor and Tesla.

Rule Your Retirement

For $149 a year, you will get recommendations for exchange-traded funds (ETFs) and mutual funds. Also, there are strategies and tips for getting the maximum benefit you are allowed out of the Social Security as well as detailed articles on topics and news influencing retirees or who are close to the retirement age.

Options

This Motley Fool feature is an advanced course for investors who want to get into the stock trading and make the best out of it.

If you are up for the challenge, you can opt for the “Options University” and start your learning journey on options strategies.

The Options costs $999 a year. It might be costly, but it is undoubtedly the best way to learn all the aspects, from basics to advanced.

Besides, there are weekly news commentary and options trade recommendations.

CAPS Community

CAPS is a crowdsourcing community destined to help the users find great stock picks. It is free of charges, and here is how it works:

The different users rate stocks based on their expected performance (in comparison to the S&P 500). Then, the Motley Fool team generates a score for every user based on accuracy. The stock receives ratings based on all the user consensus about whether a stock will go up or go down.

Users with higher ratings can impact the rating of the stock more than the other users. The “Top Fool” title is given to the user with the highest score and is displayed on the website.

Every user can provide additional information about why he or she gave the rating to that particular stock. Keep in mind that when participating in the CAPS community, every user must make at least 7 active stock picks to receive a rating.

Discussion Boards

The discussion boards are free and cover various investment topics where you will find plenty of opinions and ideas of “real” people (as opposed to professionals).

The most active boards are categorized as “investment analysis clubs,” which are devoted to a specific sector or stock type. Also, there are various other boards devoted to many individual stocks as well as the Motley Fool premium services.

Scorecard

The Motley Fool Scorecard is a helpful tool that allows the users to track their investment portfolio or other securities that they are currently watching.

Besides, when enrolling in the Scorecard, you will have the chance to enter your investments and keep track of your portfolio’s performance in one place.

The Motley Fool Scorecard has 40 data points which the option to track multiple portfolios.

Motley Fool Companies

The Motley Fool has 3 sister companies that focus on wealth management, investment management, and venture capital: Motley Fool Wealth Management, Motley Fool Asset Management, and Motley Fool Ventures.

Social Media

The Motley Fool has an active community of followers on various social media platforms such as:

- Twitter: (@themotleyfool) 725,000 followers

- Facebook: 680,000 followers

- Instagram: 6,300 followers

- YouTube: 127,000 subscribers

- LinkedIn: 160,000 followers

You will find constructive investment news, tips, recommendations, and so on. So, make sure to follow them and benefit from their valuable content.

Final Words

Since its launch in 1993, the Motley Fool has always helped millions of investors, from all levels of experience, get the best out of the stock market. There are many helpful free and paid features that provide valuable content on various financial topics. You will benefit a lot from their free content, and benefit even more when you subscribe to their premium content where you will get more stock picks, educational materials, retirement advice, and much more.

So, are you ready to beat the market, control your financial future, get on track for retirement, and improve your knowledge? Then you should definitely opt for the Motley Fool!